CSQ Properties has been acquiring a different asset class – Self-storage!

We are now a GP on 8 different properties totalling over 3,000 units!

Before we get into the nitty-gritty details, let’s first dive into this fast-growing sector in real estate called Self-storage.

All throughout our lives, we tend to accumulate things. We can say it is human’s nature to buy more stuff and keep them.

But as we hold on to more things, they keep piling up and end up filling all parts of the house, office, or apartment.

At some point, we need a separate space to store all the things we have acquired overtime.

And this is where self-storage comes to the rescue.

But what is self-storage?

Self-storage is a physical space that individuals can rent to store their belongings. Individuals rent the space, which gives them the freedom to add and remove particular items, rearrange the unit, and access anything they need within the space at their own convenience.

According to Statista, it is estimated that over 90% of the self-storage industry is in the United States.

There are many reasons we can say that self-storage is one of the coolest niches in real estate.

Thus, let’s explore more on the investment side of self-storage.

Why Self-Storage Investment?

Self-storage is a great investment opportunity. It is another class of real estate asset within commercial real estate.

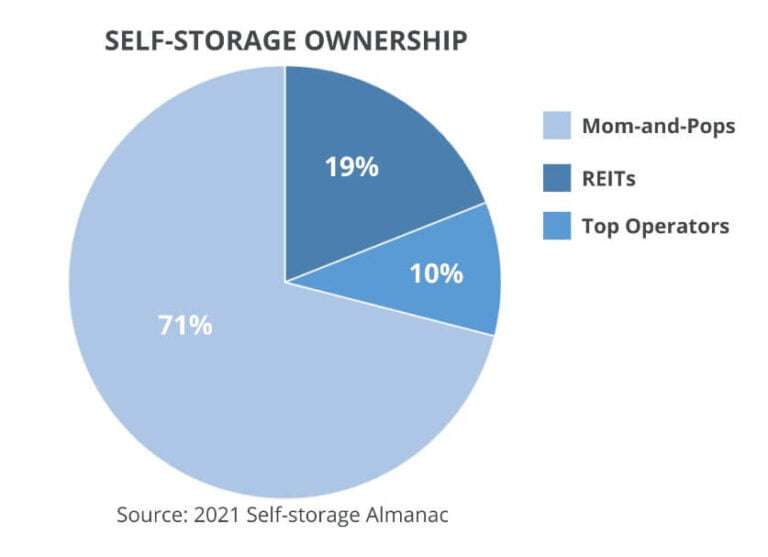

It is a huge industry. There are over 51,000 facilities operating in the U.S. today.

These facilities are so widely varied – there are plenty of privately owned facilities and sizes range from small facilities with only a few spaces to large facilities with hundreds of spaces. The bulk of ownership is still with Mom-and-Pop operators.

RECESSION-RESISTANT

The self-storage industry is said to be a recession-resistant asset class. It is projected to continue to grow, even on economic downturns.

Several factors that drive the self-storage industry growth include the increasing rate of urbanization, downsizing due to the COVID pandemic, lifestyle changes, and many more.

Thus, self-storage is influenced by transition, trauma, and lifestyle.

FLEXIBLE LEASE TERMS

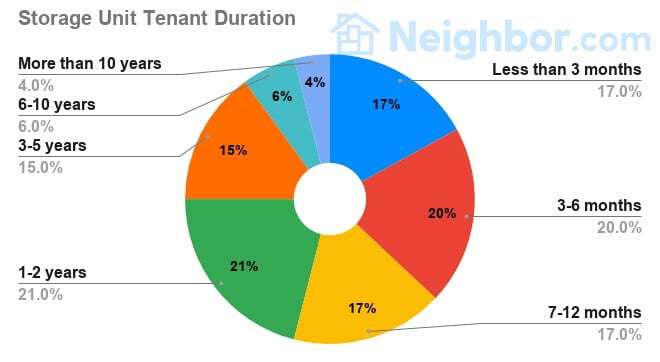

Self-storage is generally done on a month-to-month lease, which is powerful because it allows the facility owner to capture inflation, which is critical in today’s economic environment.

Unlike other investments which are locked on 1-year or multi-year contract, self-storage owners can potentially raise rates monthly to keep up with inflation.

According to Neighbor.com, the average rental duration of a storage unit is approximately 14 months, with nearly half of tenants renting for over 1 year.

MINIMAL MANAGEMENT

Self-storage facilities can be managed by as little as 1-2 people.

Why? Because the implementation of all the existing technologies from CCTV cameras, kiosks, automated gates/locks, to virtual assistants.

A manager usually needs to be on-site during the day to handle new leases, while alarms, cameras, and automated gates/locks are used during evening hours.

A storage unit is typically just walls, floor, roller door, lights, and a lock; a clean sweep is all that is needed after a renter has vacated and the space is ready for the next renter.

There is typically no need for tenant improvements or leasing commissions.

Thus, self-storage facilities are relatively low maintenance.

LOW-COST VALUE-ADDS

Self-storage has a lot of low-cost value-adds.

There’s the installation of technology like cameras, management which can be physically managed by 1-2 people, adding more units, and ancillary incomes.

Examples of ancillary incomes are truck leasing, setting up ATM’s/vending machines, and setting up tenant insurance.

Insurance companies allow you to have a cooperating arrangement with them that allows you to make additional money per month. Imagine having 1,000 units needing self-storage insurance which becomes an additional income stream!

PROFITABLE INDUSTRY

The United States is at the heart of self-storage industry.

The self-storage industry in the United States had an annual industry revenue around $39.5 billion in 2019. It had a nearly 50% increase since 2010.

Self-storage industry revenue continues to be one of the fastest growing real estate sectors in the U.S. economy, projecting an upward growth of $44.2 billion in 2024.

CSQ Properties Investment in Modbox Storage (formerly LifeStorage) located in High Point, NC

CSQ Properties partnered with PassiveInvesting.com to purchase Modbox Storage (formerly LifeStorage) in High Point, NC last February 2022.

Modbox Storage was a former showroom for Thomasville Furniture and converted to self-storage facility by LifeStorage Inc. in 2020. It encompasses 649 units on two floors. It is located on a major street with nearly 40,000 vehicles that drive by every day.

The facility is located 1.5 miles from a major retail hub which includes three grocery stores, a Sportscenter Athletic Club, a movie theater, and multiple restaurants.

It has a growing market with strong market dynamics, allowing a strong return for investors, while mitigating downside risk with future economic recessions.

Conclusion

As long as people have things that need to be stored, the self-storage industry will be profitable.

Past and present trends show that the sector is on an upward trajectory.

Since the population keeps growing, it’s safe to say that so will this industry.

After all, people will continue to collect more and more things that they don’t have room for.