The Capitalization (Cap) Rate is a common, if not the most common measurement used to evaluate a commercial real estate (CRE) property. It is the calculation of how much return an investor would get, before loan payments and taxes. If they bought the property with all cash, it would simply be the return on investment.

If this is such an important metric, it begs the question, what cap rate should I buy at? What cap rate is a good deal? Well, as with most questions, the answer is, it depends.

Some investors invest for cash flow, in which case higher cap rates carry more weight. These investors tend to invest in secondary and tertiary markets. Some invest for appreciation and they tend to invest in primary, infill locations. You can see a video we put together on this topic here.

We’ll have to dive into the numbers in a bit, but don’t let it intimidate you, the story they tell can be pretty compelling so stick with us and let’s figure this out!

The Cap Rate is the Net Operating Income (NOI) of the property divided by the purchase price.

Let’s say, you bought a million-dollar property, and it was a 5% cap rate. The return would be 5% x $1,000,000 or $50,000 per year.

Your Return on Investment (ROI) before taxes would be $50,000/$1,000,000 or 5%. In other words, in an all-cash purchase, the cap rate would be the same as your Return on Investment (ROI).

Now let’s say you used leverage, or debt, to purchase the property, as is more common. In today’s CRE market, typically you need to put down 20%-50% depending on the deal and strength of the borrower, among other factors.

Let’s assume you put 30% down, or $300,000, on this deal. It is still a 5% cap rate deal so each year the cash flow would be $50,000, but now you have debt service to pay for before the investor gets a return.

Let’s assume in today’s market you received a 3.5% interest only for a loan of $700,000. The annual payment on that would be about $25,000 but you only put $300,000 into the deal increasing your ROI to $25,000/$300,000 or 8.3% before taxes. There are some other variables that go into this, but in a nutshell, this is how you increase your returns through leverage.

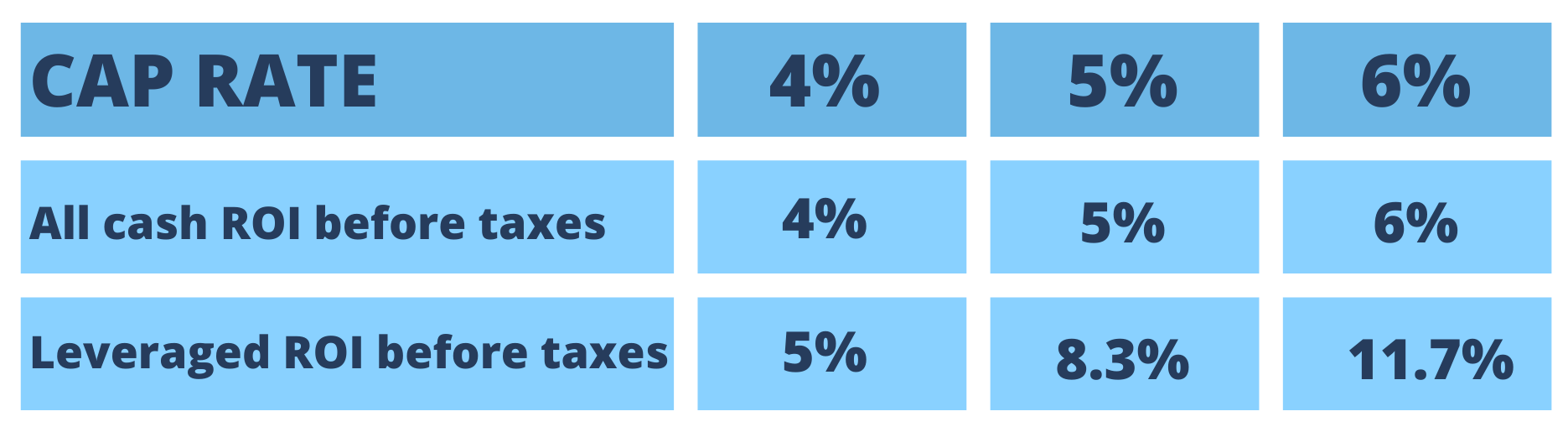

Below are some different returns based on the example above using varying cap rates.

So far, it seems clear as shown in this example that on the surface, a higher cap rate is better.

But let’s dive into it a bit more. What creates the cap rate? The market and the property do. And this can be influenced by an innumerable number of factors, so let’s look into some of them.

Let’s keep it simple and look at the all-cash deal for comparison purposes.

Understand there are countless factors that go into pricing and determining what is a good deal and what is not. It has been said, “Good deals are made, not found”.

So, before the keyboard jockeys start tearing this apart, please understand I’m trying to simplify things here. We’ll dive into more of the variables and nuances in another article – I’m trying to boil it down for now.

So, all things being equal, the Cap Rate is the required return the market dictates for a particular property in a particular area during a particular time period.

If you’re buying a great building in a great area in a great RE market, there will be more demand for that property and the cap rate will be lower or compressed.

For instance, you can buy a property near the beach in Los Angeles for about a 3% cap rate or you could buy a property in the rougher part of town in Chicago and get a 10% cap rate.

As shown in the simple table above, the higher cap rate will give the investor higher returns. Keep in mind, this ignores appreciation.

Generally speaking, there is market appreciation and forced appreciation. Market appreciation is just that, appreciation from the market increasing. Forced appreciation is the increase in the value of the building by improving the building and generally increasing rents and/or decreasing expenses.

Let’s assume expenses stay the same and for now and let’s ignore market appreciation which, by the way, can be a huge part of the return for investors. We’ll ignore it to illustrate my point about putting too much weight into high cap rates as a way to evaluate deals.

So, what happens to these properties when you raise additional capital to fix them up?

Now, this is where it starts to get interesting.

Is the purchase of a higher cap rate property always better for the investor?

You can already start to see the answer isn’t always yes. Would you rather own a building near the beach in L.A. or in the outskirts of Downtown Chicago?

Both could work depending on what you’re going for, but let’s look at what happens when you’re investing Capital Expenditures (Cap Ex) into a building for remodeling.

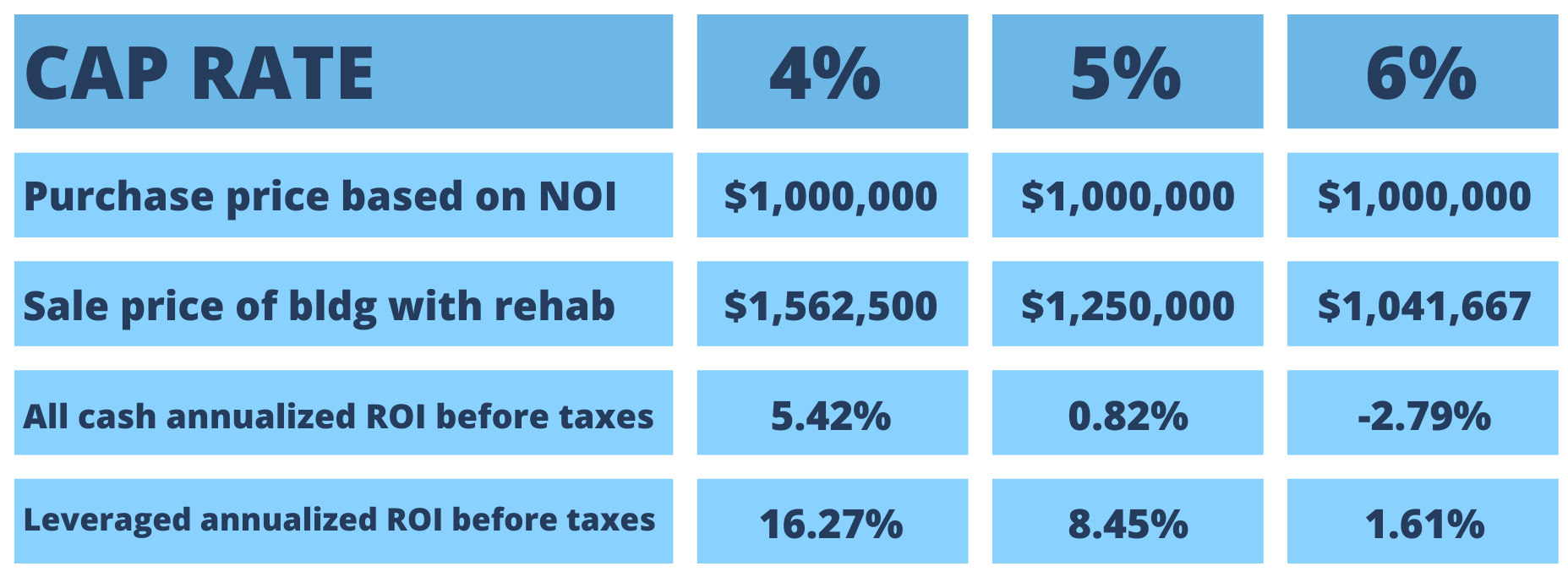

Let’s go back to the all-cash example above and assume you were investing $200,000 in rehabilitation (rehab) money to increase the rents by 25%. Let’s also assume you’re selling the building for the same cap rate you bought it for. You can make arguments one way or another, but no one can predict the future so let’s assume if you buy it at a 4% you sell at a 4%, etc.

So now the investment is $1,200,000 and the NOI is increased to $62,500 through the rent increases. When you sell at a 4% cap, the price of the property is $62,500/4% which is $1,562,500.

With the same rehab budget and selling the property at a 5% cap, you get $62,500/5% which is $1,250,000, or similarly, at a 6% cap rate, the selling price would be $1,041,667.

When you calculate the ROI for the 4% example, ROI = ($1,562,500-$1,200,000)/ $1,200,000 = 30.2% or 5.4% annual rate of return on a typical 5-year hold. The table below shows the results for the 4% and 5% options as well.

You can see from this table, that there are diminishing returns for your rehab budget if the disposition, or selling, the cap rate is too high. For the 6% cap rate example, the return is negative because you invested $200,000 in rehab but the building only increased in value by $41,667 creating the negative return. If you use leverage, your investment basis is $300k down payment plus $200k rehab and you net a positive return, albeit smaller than the other cap rate returns.

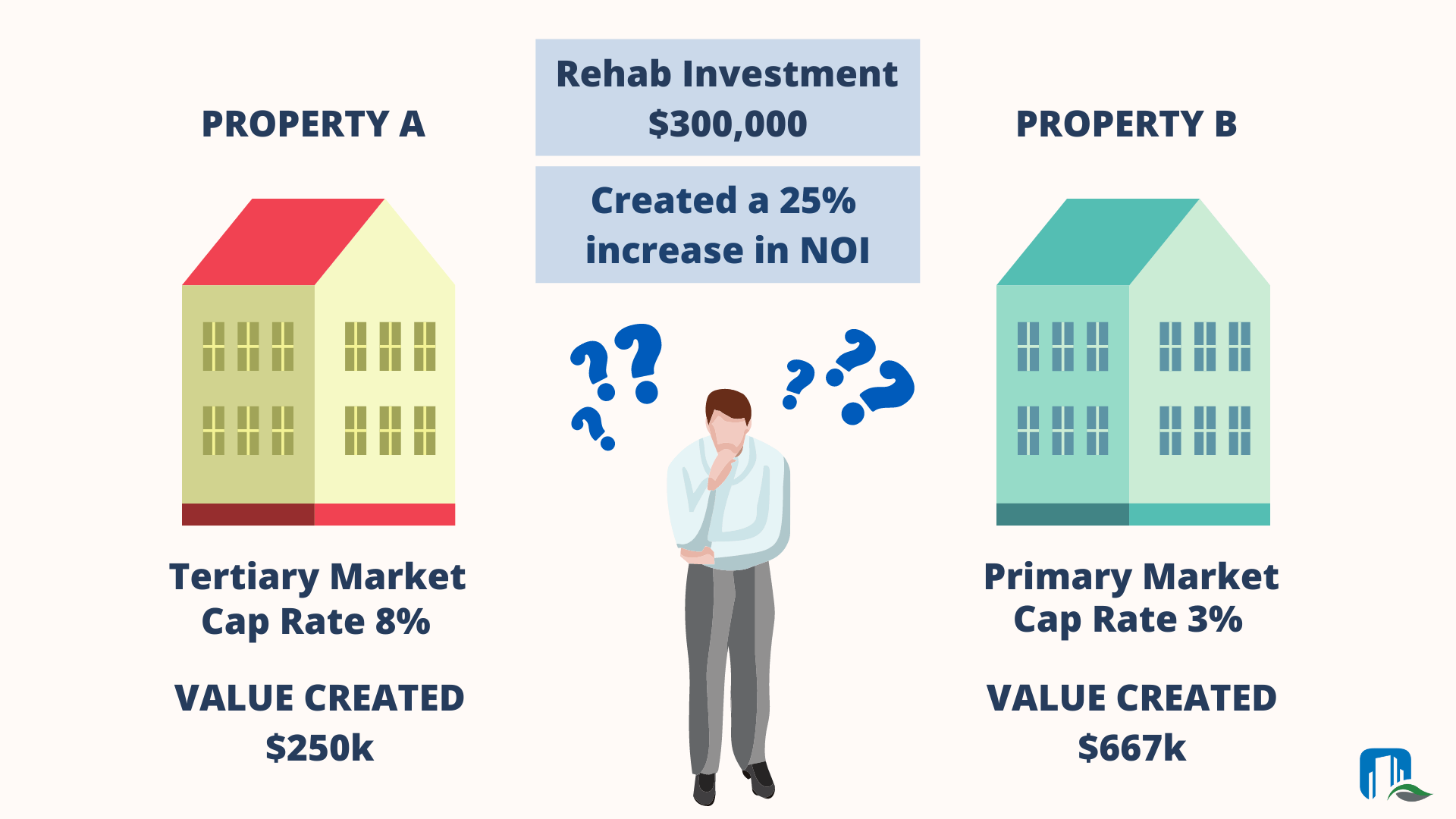

Now let’s take a look at a rehab budget example in two different markets. If there are two projects where $300,000 will be invested in rehab, which will create more value?

Property A is a 10-unit building in a tertiary market where properties are trading at cap rates around 8%. The NOI for this property is $80,000 which created a purchase price of $80,000/0.08 = $1MM. The investment of $300,000 created an increase in NOI of 25%. With this increase in NOI, the value created for the building would be $20,000/0.08 = $250,000.

Now if you looked at a similar-size building with the same rehab budget but in a primary market with compressed cap rates, what value would be created?

Property B is a 10-unit building in a primary market where properties are trading at compressed cap rates of around 3%. The NOI for this property is $80,000 which created a purchase price of $80,000/0.03 = $2.67MM. The investment of $300,000 created an increase in NOI of 25%. With this increase in NOI, the value created for the building would be $20,000/0.03 = $667k.

Dollar for dollar, the returns on a $300k rehab budget will be far higher in a lower cap rate market. You could even make the argument that the investment should not be made at all with Property A, as the $300k investment only increased the value of the building by $250k – a net loss of $50k.

In this example, the return on rehab investment is much higher in the compressed cap rate, primary market. Now there are many other factors that go into the decision-making process of a real estate project, but higher cap rates do not always mean better returns when you include the sale of the building in that market.

Most investors I come across, and even most syndicators I come across don’t think about this, but the results speak for themselves.

On heavy rehab jobs, your returns are higher if you’re buying and selling in lower cap rate markets than if you were buying and selling in higher cap rate markets.

Now there are many other factors that go into the decision-making process of a real estate project, but higher cap rates do not always mean better investments.

So, what type of cap rate markets are you buying in and why?

If you’d like to talk to us more about different real estate markets, feel free to email us or set up a call.