On February 24th,

the world watched as Russia started invading Ukraine. This kicked off historic policy actions and moves across global markets. United States and its allies began imposing extensive sanctions on Russia. Four weeks later the war continues.

As the global economy is undeniably interconnected, consequences have impacted the energy, transportation and logistics, stocks, and other industries.

But the effect on US Commercial Real Estate (CRE), thus far has been very limited.

To understand why, we have to start with a macroeconomic perspective.

How Do Sanctions Affect the Economy?

Sanctions are penalties enforced by one country on another for various reasons including to encourage a country to stop acting aggressively or breaking international law.

Currently, these are the toughest economic penalties introduced on a country of Russia’s size in several decades.

The goal is to shock Russia’s economy and weaken its access to financial resources.

Some sanctions include freezing Russian central banks assets held in the US, banning all Russian oil and gas imports, companies suspending trading in Russia, and many more.

In return, Russia has banned exports of more than 200 products, notably oil and gas.

Russia is one of the world’s top oil producers, delivering about 12% of the global supply. If more nations stop importing oil from Russia, it could further tighten the oil market and put more pressure on the price of oil globally.

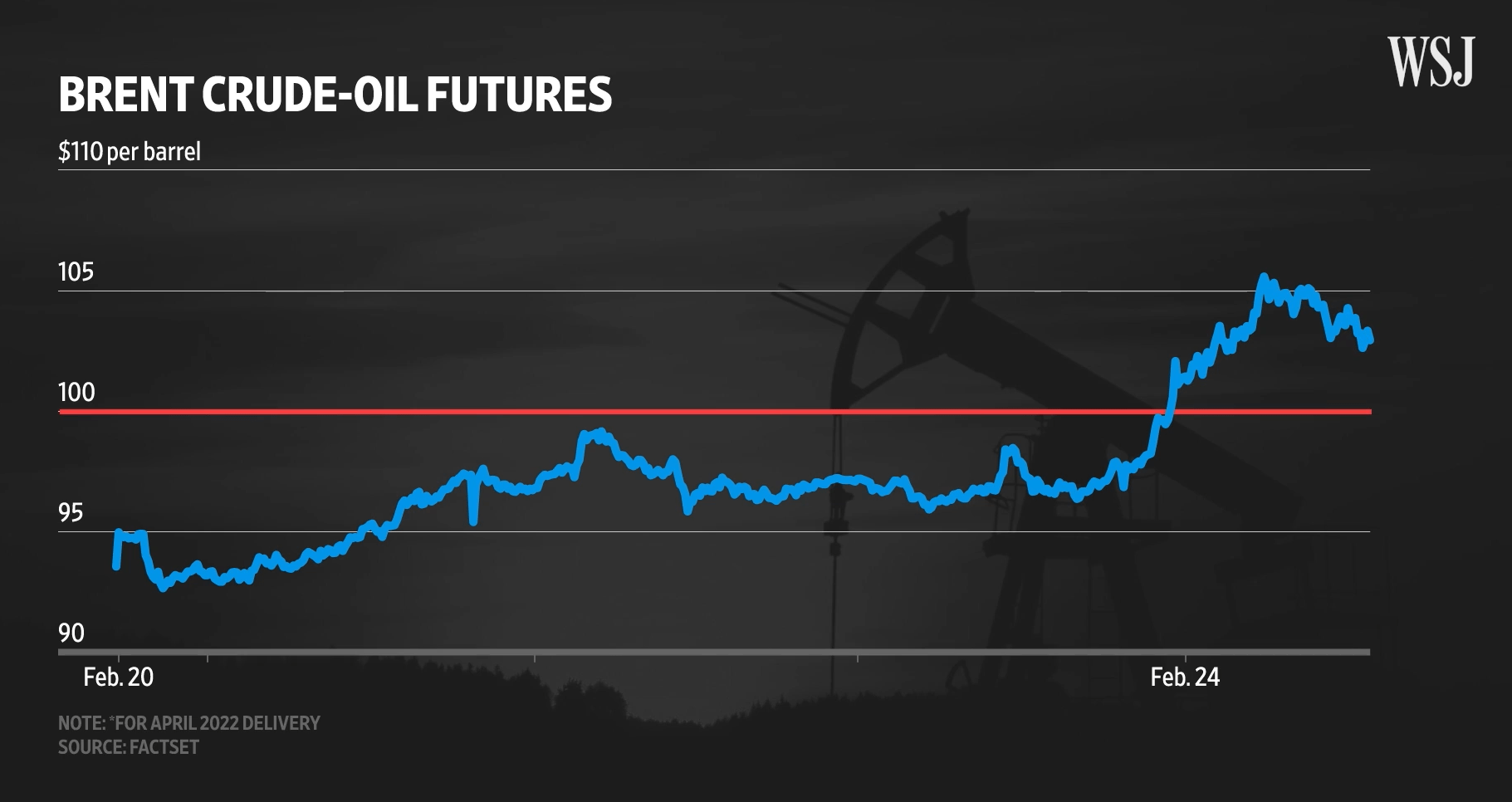

Oil prices were already on the rise, prior to the invasion. At the start of 2022, oil was in the $75 per barrel range but rose to more than $100 per barrel following the announcement of the U.S. oil boycott on March 8.

Higher oil prices impact inflation directly and by increasing the cost of inputs.

Since oil is both a key input in manufacturing and a major expense when transporting goods, oil prices have a great impact on the cost of goods.

The increase in these costs can in turn affect the prices of a variety of goods and services, as producers may pass production costs on to consumers.

Other than the surge in oil prices, the stock market is more prone to volatility during geopolitical turmoil.

According to a Special Report by Marcus & Millichap, the stock market correction placed downward pressure on long-term interest rates, while expectations of Fed rate hikes have applied upward pressure on short-term rates.

Raising interest rates is one of the most important strategy for the Federal Reserve’s efforts to control inflation.

With the ongoing situation, the Fed is pushed to favor Quantitative Tightening, that is the selling of Fed assets such as long-term bonds and mortgage-backed securities.

Quantitative tightening would reduce the Fed balance sheet, thus lowering the money supply. And implicit to this strategy would be higher borrowing costs.

Because it costs financial institutions more to borrow money, these same financial institutions often increase the rates they charge their customers to borrow money.

When the interest rate for credit cards and mortgages increases, the amount of money that consumers can spend decreases. When consumers have less discretionary spending money, businesses’ revenues and profits decrease.

Thus, businesses are not only impacted by higher borrowing costs, but they are also exposed to the adverse effects of declining consumer demand. Both of these factors can weigh on earnings and stock prices.

Effects of Russia-Ukraine Conflict on US Commercial Real Estate

Commercial Real Estate (CRE) is property that is used exclusively for business-related purposes. Most often, commercial real estate is leased to tenants to conduct income-generating activities.

Commercial real estate includes several categories, such as retailers, office space, multifamily properties, hotels and resorts, strip malls, restaurants, and healthcare facilities.

The impact of the ongoing Russian-Ukraine conflict on CRE will likely be indirect, as the effects of the conflict feed through into commodity prices, inflation, increasing bond yields, and ultimately, perhaps economic growth.

Compared to the stock market which has seen increased volatility in the face of rising inflation and uncertainty due to the war, CRE may offer a hedge against rising inflationary pressures, especially for asset classes where property owners can adjust rents and net operating income quickly.

Also, many of the factors weighing on the economic outlook and driving inflation, such as material, equipment, and labor shortages, will restrain CRE construction. This will contribute to keeping vacancy rates low and boosting CRE prices.

The combination of yield, stability and inflation resistance of real estate will become more valued by investors searching for quality, risk-adjusted investments.

Investors may also shift allocation from other investments to capitalize on the strength of Commercial Real Estate.

US real estate is recognized by many international investors as a “safe haven” during times of turmoil. This will likely be seen by the rise in the flow of capital from overseas in the coming months.

While it is wise to remain cautious about the consequences of international warfare on the US economy, the US Commercial Real Estate market will likely remain protected from major direct impacts because of the asset’s lower market volatility, its localized presence, and its ability to hedge against rising inflation.