“Real estate investing, even on a very small scale, remains a tried and true means of building an individual’s cash flow and wealth.” – Robert Kiyosaki

Today we’re going to talk about one of the best investments that Most Americans have never heard of. It offers higher returns than the stock market, lower risk, lower volatility, and is a hedge against inflation which is particularly important right now.

It also has some amazing tax benefits, in an industry that has helped create 90% of the world’s millionaires, yet accessible to most Main Street investors! So, what is this mystery investment that I’m talking about? It’s called Multifamily Syndication.

Now, it might sound complicated or something you’ve never heard of because I was at that same place once upon a time. But pay attention, Multifamily Syndication can be life-changing!

This is not an active investment. An active investment is something you have to actively manage.

Think of things such as a stock portfolio, managing rental properties, or owning an Airbnb. Multifamily Syndication is a passive investment that creates passive income. It is such an important part of Financial Freedom, that the CSQ tagline is Freedom Through Passive Income.

CSQ Properties helps others achieve Financial Freedom. What you do with your financial freedom is up to you!

I’ve made several different investments to achieve my own freedom including stocks, company partnerships, land, self-storage centers, precious metals, oil, single-family residences, start-ups, and apartment buildings.

Of all the assets I’ve personally invested in, Multifamily Syndication is by far the best!

So, let’s take a closer look…

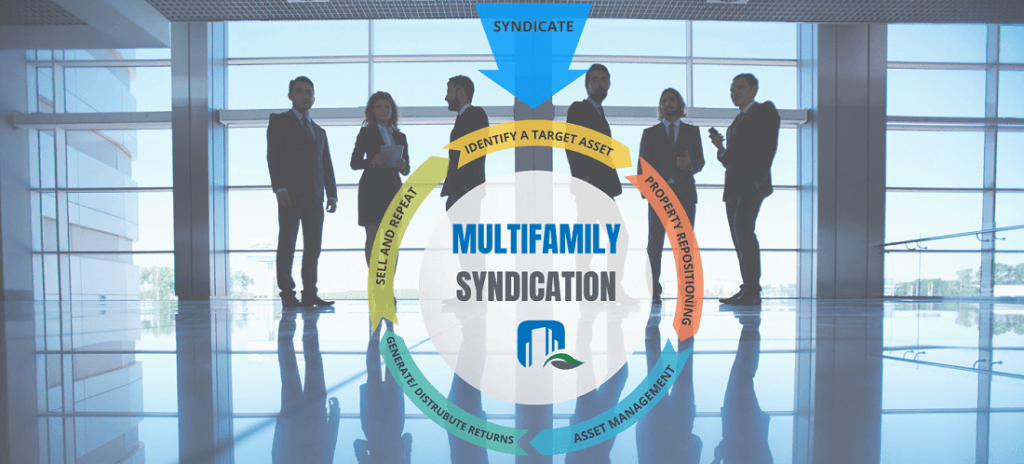

What is Multifamily Syndication?

When you join a team, you have what is called a GP/LP split. When our group buys buildings and operates them, we are the General Partner (GP). Although we invest our own money in the deal, we will go to investors and raise the balance of the investment for the deal. This comes from the Limited Partners (LP) that come in who are not part of the operations team.

They don’t get the calls when the toilets, trash, or tenants are having issues. They don’t need the expertise to run the asset or try to make the asset perform more efficiently. That’s the role of the GP.

General Partners use their expertise and experience while investing their time and money. After we buy an apartment, we oftentimes try to add value to the property by rehabbing or remodeling it. You can also add amenities such as a laundry room or fitness center. This is called Value-Add. Ultimately with commercial real estate, the value of an apartment building depends on how much income the property is producing.

There are typically a lot of turnovers in apartments. In a hundred-unit apartment building, 5-8 people will move out each month. When those people move out, you come in and do renovations.

Each unit can roughly cost $5,000-$30,000 to renovate depending on how extensive the upgrade is. You put new floors in, do some painting, update kitchens and baths, etc. and you’ll increase the value. This will also increase the rent as new folks move in. This is called Forced Appreciation.

People will gladly pay more because they want to live in a newly remodeled unit. When you increase rent, it dramatically increases the value of the property.

Typically, we hold these buildings for five years although that can vary based on a variety of factors. In that time, the property appreciates just from market appreciation, which is different from, and in addition to, forced appreciation.

And don’t forget — this is all very passive to the LPs! This is the perfect type of investment for professionals or retirees who want to increase their investments while also having time for their careers, family, retirement, or other pastimes.

So, How do the Investors Get Paid?

There are two primary ways the investor gets paid. The first, and probably most important, is through monthly or quarterly Cash Flow distributions. The building will have net operating income and after all, expenses are paid and any necessary reserves withheld, the profits are distributed to the GPs and LPs in the same percentage as their equity percentage.

Typically, this happens after the property is stabilized, meaning improvements are complete and the units are leased out.

There is also the appreciation of the property that is realized upon sale. After all original investments are returned, the balances of the gains are distributed in the same percentage as their equity percentage.

There are some other incredible benefits when you invest in Multifamily Syndication. So, let’s get into some of the more important ones.

Higher Returns with Lower Risk

There are significantly higher returns in Multifamily Syndication versus stocks or other investments.

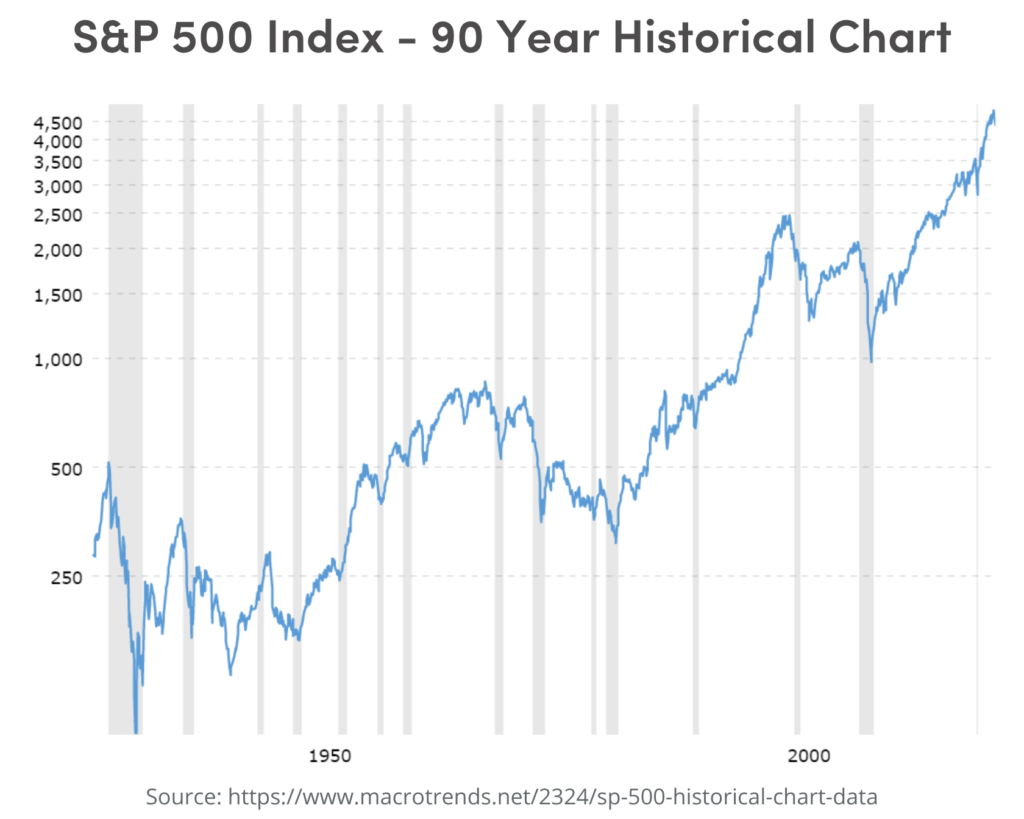

As of Dec. 2021, the S&P 500 for the last 100 years, has returned 10.8% but this does not include fees and taxes. If you include those, the yield is more like 6-8%.

In multifamily, it’s very common to see 12 to 18% returns per year, after fees. Usually, higher returns equal higher risk. In this case, it’s not actually true!

Lower Risk and Volatility

Warren Buffet famously said: “Rule No. 1: Never lose money. Rule No. 2: Don’t forget rule No.1.” So, whatever you do, you don’t want to lose money.

2009 was the worst point in the Great Recession. Everything from stocks to real estate decreased significantly. A lot of people think that real estate is real estate, right?

They think single-family is the same as multifamily. It is actually very, very different. In 2009, 4% of single-family properties were delinquent nationwide, meaning people were either in foreclosure or at least 60 days behind on their payments. That’s 1 in 25 houses!

During that same period, large multifamily (meaning 60 units or more in a building) delinquency was 0.4%. That means 1 out of every 250 were in default or foreclosure.

Compared to multifamily, single-family was 10 times more delinquent.

Why is that? If people lose their houses, where do they go? They go to multifamily apartments. Even in bad times, everybody needs apartments.

Further reducing the risk is the supply and demand issue right now.

The population is growing continually and according to www.weareapartments.org we’re going to need 4.6 million more apartment units by 2030

Construction costs are going up and as of Jan 2022, inflation is at 7.5%, the highest in 40 years. These apartments will become more valuable over time which means that rents will continue to rise.

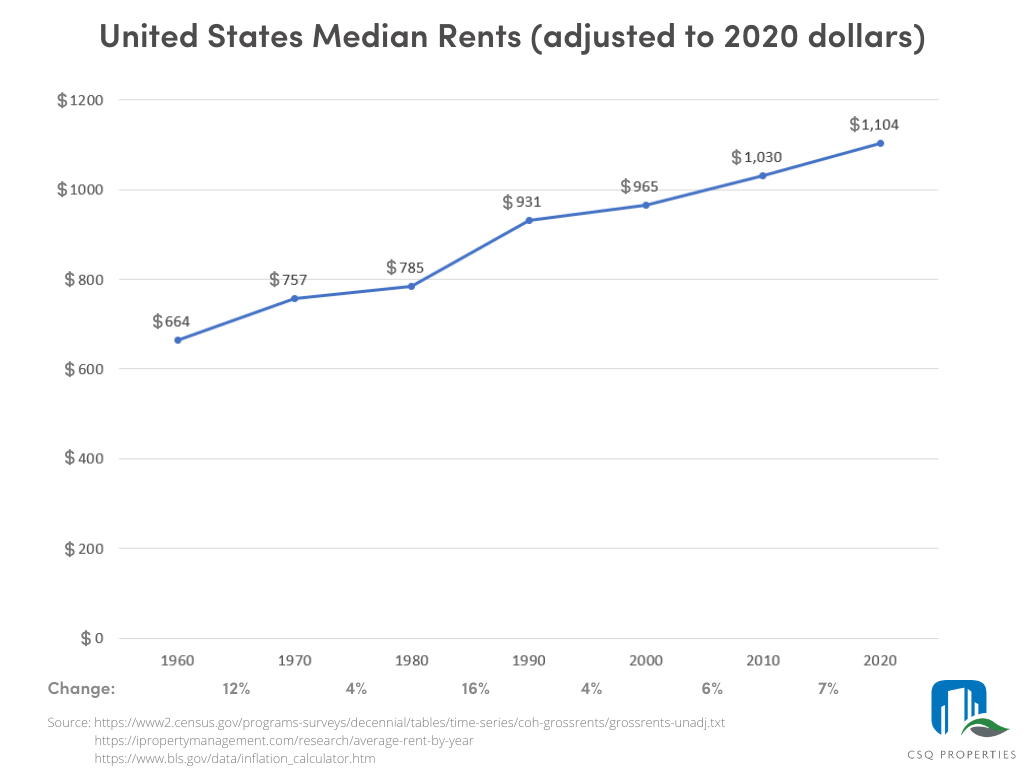

If you take a look at the chart below, you can see rents of the last 60 years adjusted for inflation. There’s a long-term trend that shows an increase in income from these properties.

The value of multifamily syndication is based on rents, so the income potential is much more stable.

Alternatively, you can see on the chart below the volatility that happens when you’re investing in stocks. The numbers speak for themselves!

Tax Benefits of Multifamily Syndication

This isn’t any specific tax advice (consult your CPA) but it’s important for you to learn about the potential benefits. The first thing is depreciation.

So, when you own a property, you can write off the entire cost of the structure over a number of years. This gives you a substantial benefit on your taxes.

You can also do a cost segregation study which allows you to bring some or all those 15 to 30 years’ worth of losses forward to year one. Think of it like passive tax loss.

So, let’s take a look at an example. Let’s say you invest $100,000 into a multifamily deal. On paper, it often will show a $60,000-$80,000 passive loss during year one. Don’t worry, it’s just saying this on paper!

Over the next five years, let’s say that this property has $35,000 worth of cash flow before the property sells. What you can do is use those passive tax losses toward those gains. Multifamily investments allow you to use the money for the next five years and not pay any taxes until the property is sold.

At that point, there is something called a depreciation recapture, where you recapture the depreciation. Some people will pay taxes, while others may perform what is called a 1031 Exchange, which can further postpone capital gains tax.

Alternatively, you can use the tax savings from retirement accounts that can work on a tax-free or tax deferred basis. A Multifamily Syndication allows you to do this in cash accounts, retirement accounts, entity structures, Qualified Retirement Plans, etc.

By planning correctly, you can grow your investment on a tax-free or tax deferred basis. People do this that makes hundreds of thousands to millions of dollars per year. They’re able to invest money and create passive income. They’re able to obtain Financial Freedom by investing passively in Multifamily Syndication.

Tax Benefits of Multifamily Syndication

Multifamily is an incredible inflation hedge. Today, it’s unbelievable how much money is being printed. In fact, 40% of all the dollars in existence were printed in the last 18 months. That is absolutely astounding!

So, what happens when you have inflation? The value of the dollars you hold goes down. It penalizes savers and rewards most borrowers. As inflation picks up, we don’t actually know how high the number is. A common measurement is the Consumer Price Index (CPI), but the products that go into this calculation change over time, making it very difficult to make historical comparisons.

Inflation was just reported as 7.5% (the highest in 40 years!), but if you use the same products to calculate it as were used in 1980, we are over 15%! So, what’s the real number? There’s no definite number but either way, the purchasing power of cash is being eroded away. Quickly!

When you own assets such as multifamily investments, it creates a hedge. In other words, there’s protection. It doesn’t affect you in the same way if you were to just hold cash. This is because it’s a real asset that increases in value as inflation increases. In short: You are protected in the time of inflation.

How does this work? How do you use debt to increase your wealth and have a strategy to combat inflation? The average purchase price for multifamily properties is leveraged with 70% debt.

For example, let’s say we have a $15 million property, and we owe $10 million on it. This sounds like a lot of money, but tenants are paying the rent. Essentially, they’re paying for the mortgage and expenses. AND then there’s money left over. Over time, the value of this property is going to increase.

Why?

Because of inflation. We’re adding value by renovating units and increasing the rents to match those remodeled units. We’re also paying back the debt with future dollars.

So, what that means is we’re getting long-term fixed debt and paying it back with that cheaper, future money. This allows you to both increase the value of the property as well as pay everything back.

It’s basically a double positive, right? What it effectively allows you to do is to short the dollar. When you short something you believe the value will go down and when that happens, you profit from that.

So, when we say we want to short the value of the dollar, we’re saying we believe the dollar is going to go down. How we get behind that is we take on fixed debt. We know the value of those debts becomes less over time because the value of dollars becomes less over time.

We are going to have a period of significant inflation and it could potentially get worse.

Being prepared in any way is really important, and Multifamily Syndication is a great way to do that!

I hope this article gave you some new ideas. I know it’s a long one, but if you made it this far, hopefully, you learned a few things. An investment in knowledge really is the best investment that you can make!