Despite eviction moratoriums getting extended, collection rates remain very high and vacancy rates very low. Since March 2020, the overall collection rate for CSQ Properties has been 99% and the vacancy rate has been less than 1%. This is better than the assumptions made in our underwriting before Covid began! According to Marcus & Millichap, on a national scale, vacancy is at a 20 year low as shown in the graph below.

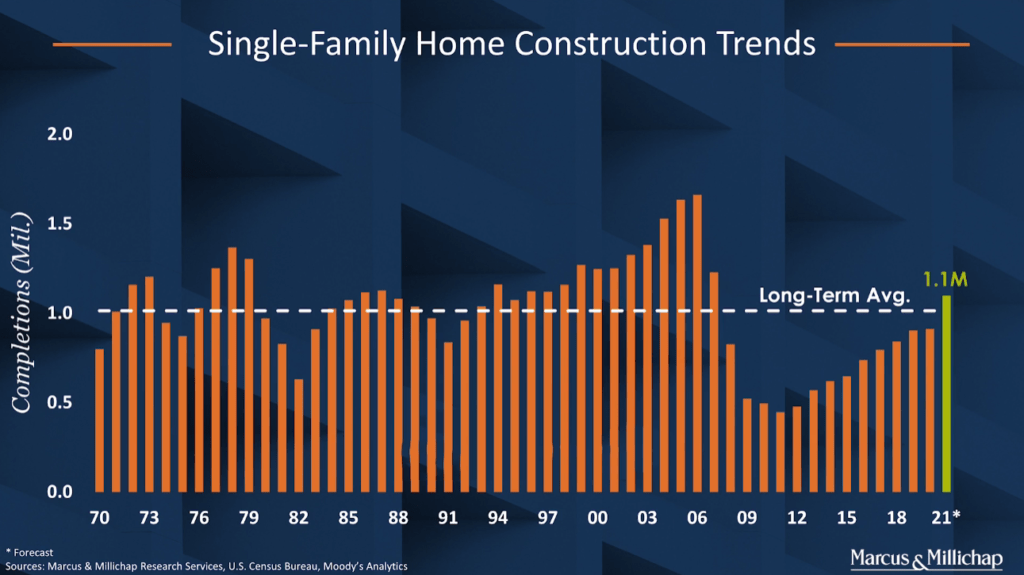

There is a lot of talk about a housing bubble but it is important to recognize that we are in a much different situation than in 2008 – primarily because of inventory. The U.S. construction industry has never fully recovered if you look at the historical numbers. Using single family construction builds as an indicator, the 40 year average from 1970-2010 was about 1 million new builds per year. As you can see in the chart below, for the first time in 13 years, we are finally getting back to the 1 million long-term average. Construction has not kept up with demand and depending on which source you look at, we will still be about 400,000 units short of demand for 2021.

This coupled with the Millennial generation moving into places of their own, there is a lot of upward pressure on housing pricing. These factors are applying an upward pressure on housing pricing creating a very strong demand for multifamily rentals. According to the National Multifamily Housing Council, 95% of renters made their monthly payment in July, which is less than 2% below the July 2019 results. As in 2008, once again multifamily is proving to be a very recession resilient investment offering exceptional risk-adjusted returns.

If you’re interested in learning more, please reach out to us.