In this issue:

- Property Quarterly Financials

- Property Updates

- Team Member Spotlight

Property Quarterly Financials

We’re excited to release 2020 Q1 financials for each of the respective properties. Please login here and click the “Documents” tab to see the financials for the respective properties you are invested in. Although the Corona Virus continues to have repercussions throughout most industries including Real Estate, CSQ has been taking preventative measures to maintain a strong cash position and make all attempts to be compassionate to struggling tenants. We also believe there will be some good buying opportunities in the near future and are encouraging CSQ investors to maintain a strong cash position to take advantage of these opportunities. We are currently evaluating several properties and keeping a close eye on the multifamily real estate market to take advantage of these opportunities when they arise.

Property Updates

1955 Locust Ave

After successful construction and re-leasing of the property, the bank released the earn-out portion of the loan which returned a third of the capital to the investors. This building remains 100% occupied and April collections were at 90%. We are working with non-paying tenants to develop a payment plan to come current on rent. The maintenance, mortgage, and property taxes remain up-to-date for this property as we navigate the Corona Virus waters.

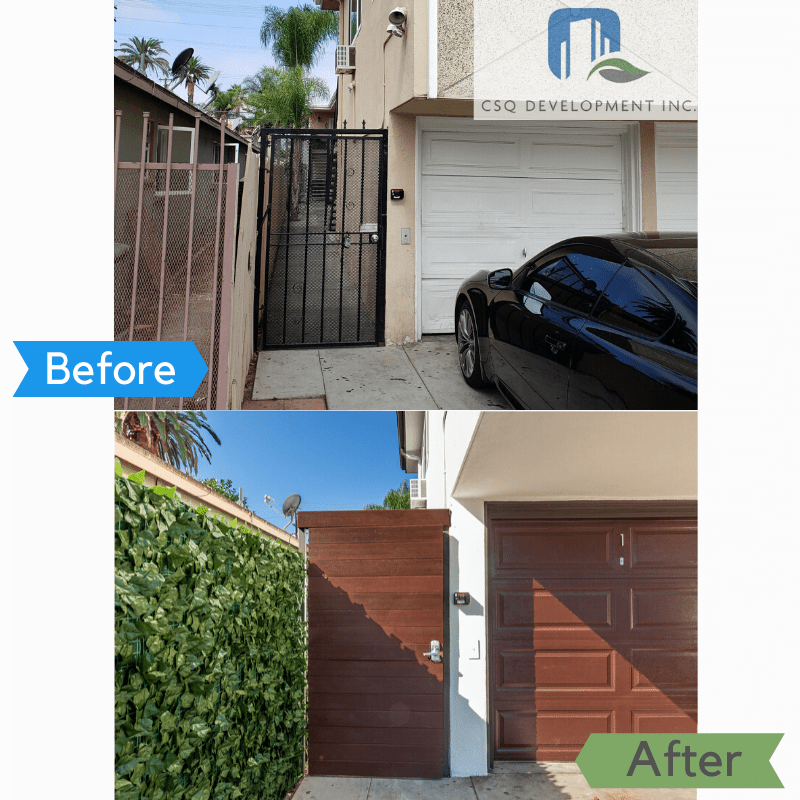

It’s a common belief that curb appeal and entrance to a home is critical for the value of a home and we took a similar approach to this project. Although there is only so much you can do with a smaller apartment building, we think it was a great improvement!

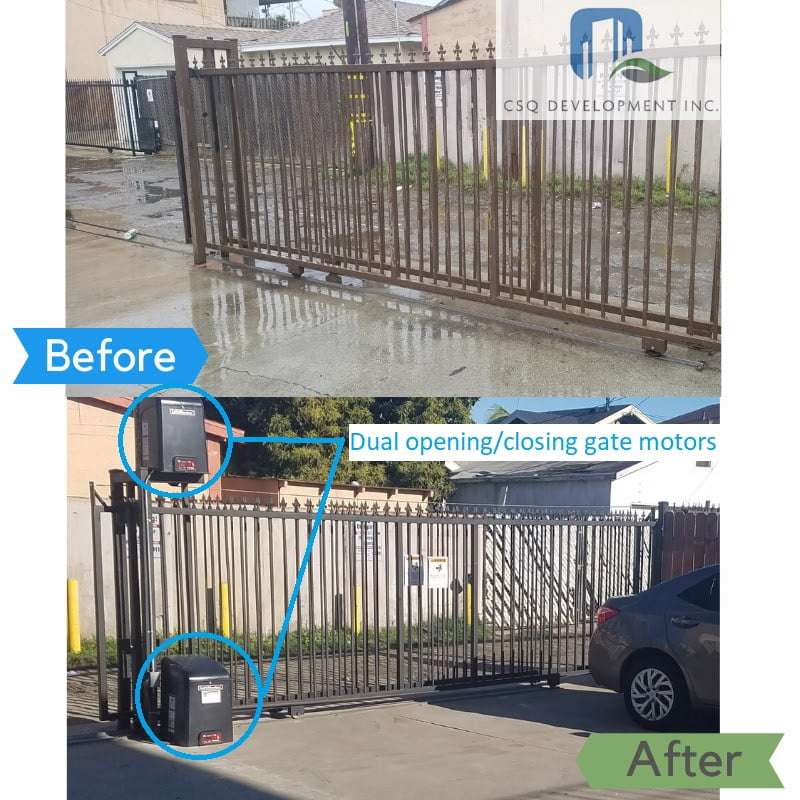

Even the back of the building was improved significantly. And if you think about it, this is the main entrance for half the tenants!

8455 Eton Ave

In an unexpected turn of events, the previous operator for this sober leaving house had to be removed. CSQ will be stepping in as the operator for this house in the interim. Expect to hear about many improvements to this property as we continually, “Find a Better Way” to serve the women and children who call this home.

Reseda Medical Arts Building

This property continues to perform well and collected 100% of the rent payments for April!

Click here to see all updates on Reseda Medical Arts Building

1470 Elm Ave

In a positive surprise during the Corona Virus Pandemic, two additional units out at this building were leased two weeks ago. This speaks to the demand for upgraded B class apartment units in the Long Beach area. On the downside, according to Marcus & Millichap, only 74% of rental payments were made for April 2020, due to the Pandemic. This is consistent for what we saw at this property with a collection rate of 75%. We are working with non-paying tenants to develop a payment plan to come current on rent. The maintenance, mortgage, and property taxes remain up-to-date for this property as we navigate the Corona Virus waters.

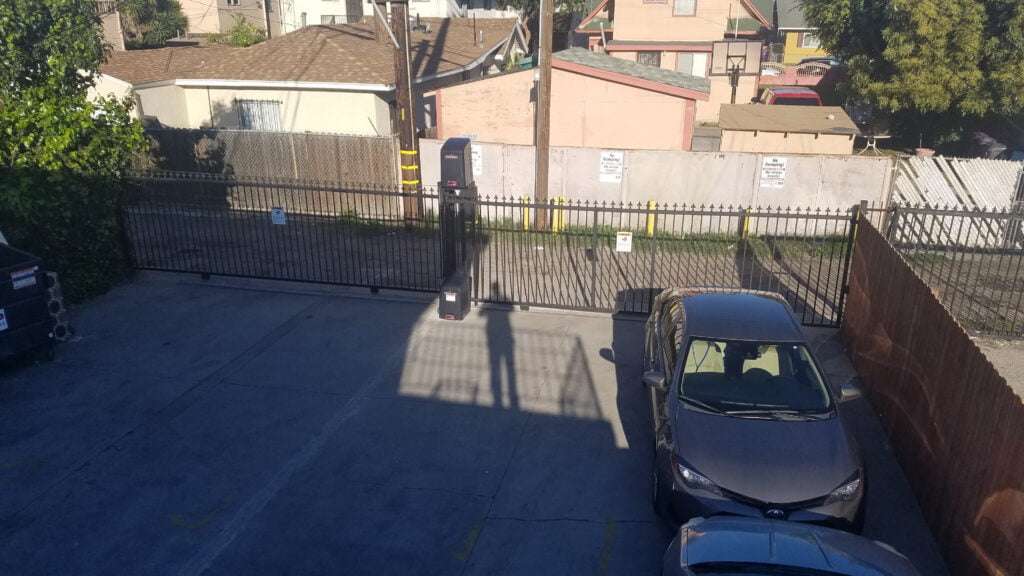

One way CSQ is utilizing its corporate core value of “Innovation” to drive tenant value and investor returns on this property is with parking. The original on-site parking lot had a sliding gate with technically 8 spots behind it. However the gate blocked two of the spaces, creating only a single space use in each of two tandem spots. The innovative approach of installing dual sliding gates with dual motors allows for full use (and rental) of 8 spaces instead of 6. This will provide more rental income from the property and more usable space to the tenants. Parking in Long Beach is at a premium and the ability to offer tenants additional private, enclosed parking is very valuable!

Team Member Spotlight

This month we are interviewing one of the original investors in CSQ Properties. In fact he has been investing in Real Estate since 1994 and has invested in the last two buildings CSQ purchased. At first glance it may seem odd to interview an investor as a “Team Member”, but in reality our investors are just that – team members. They play an essential role to getting a project off the ground and completed. For that reason, we decided to interview Larry Tchamkertenian.

When did you first get into Real Estate (RE) and what got you started?

Well, I earned a dual degree in finance and real estate from CSUN. I knew early on I wanted to get into Real Estate. My first investment was a single-family residence I purchased for rental in the San Fernando Valley in 2009. It was in foreclosure which was very common at the time.

What did you learn investing through the 2008 housing bubble?

I learned to get in after the bubble! My first home was bought in 1994 right after the earthquake and my first investment property was bought in 2009 after the financial collapse.

What was one of your riskier investments that panned out best?

My second investment was purchasing my current house in 2010 and renting out my previous house. Then, shortly thereafter I bought my first multifamily property which was a 7-unit building in Canoga Park. I didn’t know anything about commercial real estate so it was a bit risky. I searched for a property for several years before jumping in. There was a lot of unknowns with that property. Shortly after buying it I learned I needed new piping, a new water heater, and several other maintenance items. Despite all these headaches, I’ve learned that long term, it’s a much less risky investment than SFRs [Single Family Residences]. I’ve had squatter and eviction issues, and these are more costly on an SFR than a multifamily property. It also seems like you can always lower an apartment rent by $50-$100 to get it rented and the economics of the deal won’t change much. SFR leasing tends to move slower and you have a smaller pool to rent to. From an ROI [Return On Investment] standpoint, it can be higher on a house if you have the same renter in there for 5 years or so, but when you account for risk, I think multifamily is the way to go.

How do you think the RE market is going to react to the Corona Virus?

I think there is negative short-term pressure because new Corona Virus tenant regulations that prohibit eviction for 6 months in CA and 12 months in L.A. In the long-term, I haven’t changed my outlook. If anything, people are going to get used to working from home and learn how to do that. As they spend more time at home, they’ll be more inclined to have better living conditions. If they aren’t driving as much and spending money/time commuting, they can put that into their living environment.

Where do you think the RE market is headed?

If commercial real estate ends up no longer protected by Prop 13, then the upside may be limited. It will be more defined because you may not have the property tax increase windfall upon a property sale. If property taxes are tied to rental income increases, this could put a damper on returns. But on the other side, L.A. has a housing shortage, so overall I think multifamily will be the better investments in the long term.

What made you want to invest with CSQ?

I’ve been interested in acquiring another apartment building but with cap rates where they are now, you need a larger down payment to make it cash flow and as cap rates have dropped in the areas I invest in, Long Beach seemed more attractive. The fact that I didn’t have to deal with any of the headaches or management of the property made it attractive as well. It also helped that I know Chad, his work ethic, and him being somebody I could trust made it worthwhile for me.

What are your long term RE plans?

I’ve thought about retail and traditional commercial real estate but these tenants seem to be very susceptible to the economy. During a downturn the owners may need to cover the mortgage and expenses for several months or years and you need to have deep pockets for this. Overall, I’d like to stay with syndicated multifamily deals when looking at the returns and risk profiles.

All in all, things are doing well despite the chaos the Corona Virus has thrust us into. We hope you and your loved ones are safe and healthy. If nothing else, the lockdown gives us a chance to repriortize what is really important. If making long-term generational wealth from passive investments is one of those things, please keep CSQ in mind and reach out to us.