WHAT IS HYPERINFLATION?

Hyperinflation is when there is a rapid and excessive price increase in an economy.

As Inflation refers to the rising prices of goods and services over a period of time, Hyperinflation on the other hand is when the inflation rate exceeds 50% for a period of a month.

For example, if you bought certain necessities last month for about $200, and you buy the same number of necessities this month, but they cost you $350 now, then there is a 75% increase in price. This is what you call Hyperinflation.

WHAT CAUSES HYPERINFLATION?

Hyperinflation usually happens when there is a substantial rise in money supply that is not supported by economic growth.

This money supply can be increased by the US Federal Reserve by printing more money, thus devaluing the legal tender currency.

Typically, the Fed steps in as a bidder and purchases government bonds and other types of assets, such as mortgage-backed securities, in order to increase the money supply.

Increasing the supply of money lowers interest rates. When interest rates are lower, banks can lend with easier terms that stimulate the economy. This bond-buying program of the Fed is called Quantitative Easing.

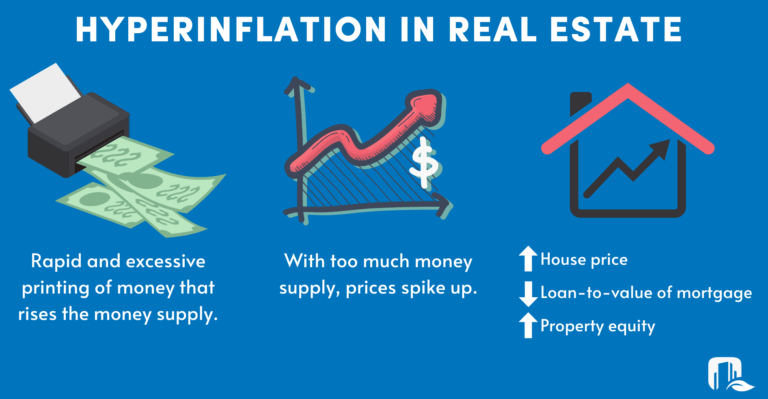

HYPERINFLATION FROM A REAL ESTATE POINT OF VIEW

Is hyperinflation good or bad? It depends on one’s point of view.

Owners and investors of real estate properties may like to see some high inflation as that raises the value of their real properties, which they can sell or rent at a higher rate.

Real estate investors have the advantage especially when they acquire properties with fixed financing rates.

As a house price rises over time, it lowers the loan-to-value of mortgage debt, acting as a natural discount. As a result, the equity on the property increases, but the fixed-rate mortgage payments remain the same.

According to Forbes, real estate can be a good hedge against inflation because property values over time tend to stay on a steady upward curve.

Real estate investments can also provide potential recurring income for investors and can keep pace or exceed inflation in terms of appreciation.

One way to use real estate to hedge against inflation is to invest in a multifamily property.

Unlike some commercial properties, individual rental units usually renew leases every year. In addition, multifamily properties like apartment complexes are a unique asset class in that they are always in demand.

Due to the increase in labor and material costs, there can be a limited supply of buildings or new development projects, which can create an increase in rental rates and property values.

There will always be aspects of inflation that are unavoidable, from higher prices on consumer goods to an increase in interest rates.

On the brighter side, however, is that even if the predictions become reality, real estate is one way to shield a person from some of the inflation’s other effects.